Investment Approach Wise Performance As on 31/12/2025

Sorting On

Customised Portfolio Approach 14

13/08/2025

0.40

30.02

49.58

NA

NA

NA

NA

NA

NA

84.34

Customised Portfolio Approach 15

16/09/2025

2.00

22.52

37.05

NA

NA

NA

NA

NA

NA

46.55

Customised Portfolio Approach 16

24/09/2025

4.37

22.48

37.00

NA

NA

NA

NA

NA

NA

41.06

Customised Portfolio Approach 13

19/06/2025

0.58

22.11

33.87

47.33

NA

NA

NA

NA

NA

43.76

Core Value

01/04/2007

109.70

9.52

1.88

10.11

-7.09

3.00

8.06

10.04

23.95

14.33

East Green Quant Strategy

03/05/2024

4.13

8.33

9.07

8.36

0.64

NA

NA

NA

NA

5.72

Principal Fund

01/04/2007

9.60

7.26

-5.78

-6.52

-14.60

0.50

9.08

4.88

15.30

31.18

Alder Capital- Dynamic Growth

03/05/2024

20.38

6.72

12.67

19.16

30.81

NA

NA

NA

NA

22.35

Maxiom PMS-EMERALD-NE Diversified Mutual Funds (Non-Equity)

01/04/2025

10.02

6.52

12.12

21.07

NA

NA

NA

NA

NA

25.44

Alder Capital- B2C Growth

05/10/2015

34.59

5.72

9.37

13.39

20.97

18.93

17.75

7.60

9.40

13.59

Abakkus Select Opportunities Strategy 2

01/09/2023

413.06

5.67

0.65

-2.90

4.04

16.12

NA

NA

NA

19.67

Kotak FinTech Investment Approach

29/03/2018

23.44

5.15

24.61

10.44

9.96

9.47

15.20

9.47

13.99

13.68

Aequitas India Opportunities Product

01/02/2013

4264.64

5.07

12.66

28.15

41.81

26.75

45.37

38.18

45.18

33.13

Growth Mantra Fund

19/10/2020

124.47

4.76

9.61

14.08

8.17

15.42

18.23

8.98

13.49

14.72

PCS SECURITIES LTD ALYATTES 00017643-001

30/11/2023

35.24

4.19

15.89

17.07

15.08

25.68

NA

NA

NA

25.29

QUANT

23/11/2023

2.12

4.19

8.17

0.92

-9.69

5.15

NA

NA

NA

4.05

Globe Arbitrage/Special Situation

14/01/2008

263.54

4.03

4.66

6.03

7.24

9.87

16.79

13.75

20.96

14.89

Abakkus Select Opportunities Strategy

20/07/2021

316.68

4.01

10.12

9.23

14.37

15.98

14.04

12.94

NA

23.49

UNICORN MID - SMALL CAP ALPHA PORTFOLIO

07/10/2024

1.09

3.73

9.87

6.73

3.84

NA

NA

NA

NA

6.28

Alchemy Select Satellite

30/11/2023

4.42

3.70

10.84

0.36

4.72

8.93

NA

NA

NA

11.67

ALCHEMY W.I.N STRATEGY

31/10/2023

109.21

3.59

11.03

0.15

3.15

7.10

NA

NA

NA

15.20

GROWTH

31/05/2021

808.66

3.31

5.81

11.84

4.72

14.06

24.67

27.23

NA

27.78

DIVIDEND YIELD APPROACH

26/11/2019

743.15

3.28

2.22

0.90

6.81

15.23

33.33

28.74

28.31

23.39

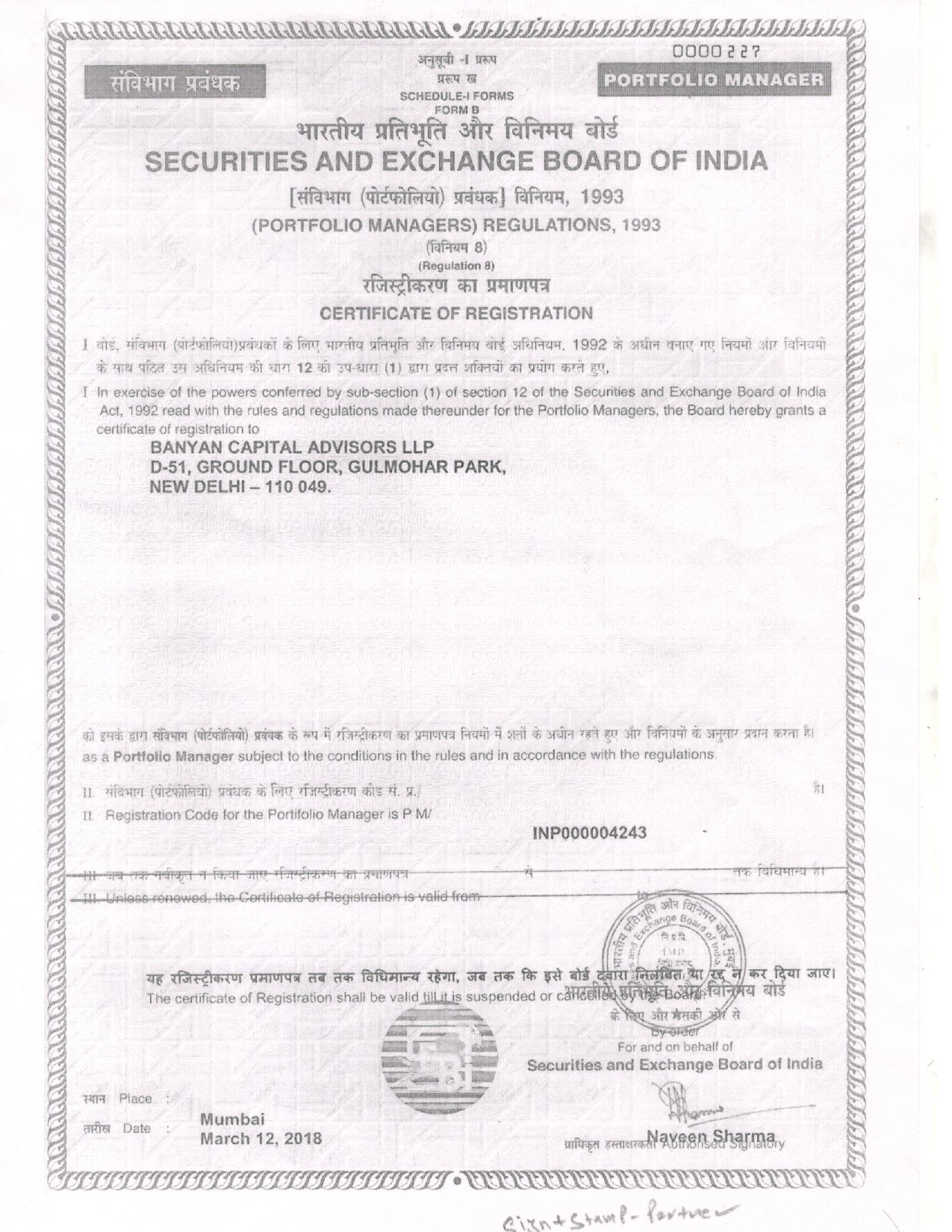

Banyan Edhas Portfolio

29/05/2023

43.38

3.26

8.79

3.02

10.21

11.45

NA

NA

NA

18.64

PriceBridge HoneyComb

16/01/2023

37.76

3.22

8.49

10.26

16.69

15.74

NA

NA

NA

17.13

Motilal Oswal Hockey Stick Multi Cap Portfolio

19/02/2024

10.17

3.21

8.71

6.03

-6.99

NA

NA

NA

NA

5.03

Consortium Securities Value PMS

18/08/2014

99.83

3.19

10.51

6.61

9.93

12.22

24.79

18.45

31.20

27.53

Wallfort Avenue Fund

01/04/2022

140.15

3.17

8.32

16.42

10.13

18.88

32.34

NA

NA

27.05

Itus Fundamental Value Fund

01/01/2017

1326.60

3.11

7.63

4.14

6.64

9.65

14.72

10.06

13.66

18.12

Large & Emerging Alpha Portfolio Strategy

17/02/2025

0.30

3.11

8.85

9.24

NA

NA

NA

NA

NA

19.71

Growth Enabled Mid & Smallcap

17/02/2025

0.31

3.09

9.83

14.28

NA

NA

NA

NA

NA

38.40

Special Opportunity Fund

28/01/2010

538.02

2.82

-7.56

8.15

-15.47

-6.43

0.87

2.07

12.19

20.44

Aurum Micro Cap Opportunities

13/06/2023

4.76

2.78

-2.95

-17.53

-20.04

-7.90

NA

NA

NA

-2.28

FOCUS MULTICAP

13/06/2021

89.75

2.75

6.34

6.15

8.83

10.57

19.87

14.82

NA

15.36

INCA

18/10/2023

31.05

2.75

1.42

-2.82

2.82

15.46

NA

NA

NA

20.16

Multi-Asset Portfolio Bespoke (A7)

17/10/2024

0.62

2.72

8.20

13.34

15.97

NA

NA

NA

NA

19.17

VALUE

15/01/2008

0.73

2.72

6.86

5.08

12.46

14.07

18.86

12.98

19.07

15.49

Abakkus All Cap (FPI) Approach

01/04/2022

4042.42

2.71

10.36

9.37

8.94

17.25

22.91

NA

NA

15.11

PriceBridge Direct Mutual Fund

30/05/2023

11.34

2.70

7.79

6.68

11.88

13.59

NA

NA

NA

20.32

FCI LLP Wealth Optimizer II

04/06/2021

15.47

2.69

8.97

17.88

30.74

26.25

25.54

19.75

NA

18.81

Customised Mutual Fund Portfolio (A4)

02/03/2020

47.29

2.52

8.94

14.47

16.44

21.00

23.34

15.18

15.84

15.93

Sanctum Global Allocator

29/11/2018

1.16

2.49

4.97

17.92

30.02

20.43

17.42

7.86

8.87

11.67

Alchemy High Growth

08/05/2002

743.80

2.47

10.85

4.41

7.00

11.88

18.09

11.04

14.75

20.35

Unicorn Focused 20 Portfolio

07/10/2024

0.80

2.44

6.63

4.39

10.13

NA

NA

NA

NA

3.51

BB Money Plant

05/03/2025

14.72

2.41

4.00

5.00

NA

NA

NA

NA

NA

24.91

Fisdom Wealth Edge

20/12/2024

85.76

2.41

8.24

7.92

13.46

NA

NA

NA

NA

13.28

Wealth Mantra Fund

30/09/2019

221.36

2.36

11.66

13.63

17.68

18.72

24.33

16.47

19.28

17.88

Motilal Oswal Midcap Multifactor Strategy

29/09/2021

1.83

2.35

10.01

3.76

3.19

15.41

27.44

17.41

NA

17.54

SageOne Small Cap

01/04/2019

1044.54

2.27

-0.08

-7.91

-7.04

3.20

12.92

6.83

18.72

21.75

CENTRUM FLEXICAP PORTFOLIO.

20/06/2011

39.28

2.26

8.28

3.36

12.00

13.46

19.35

10.83

16.52

13.01

Lighthouse Canton Sectoral Shift Strategy

04/09/2025

21.32

2.24

5.11

NA

NA

NA

NA

NA

NA

4.41

Uppercrust Prosperity Fund

19/07/2024

12.27

2.24

4.47

2.57

10.00

NA

NA

NA

NA

0.41

PATERSON CUSTOMISED

01/06/2024

89.80

2.22

5.72

2.51

0.82

NA

NA

NA

NA

0.22

ALLWEATHER

26/05/2016

84.71

2.21

0.00

0.00

-1.47

0.00

0.00

0.00

0.00

0.00

INDIA INFRA OPPORTUNITIES

05/06/2025

20.59

2.07

2.51

0.43

NA

NA

NA

NA

NA

0.68

Ametra FactorCore PMS

12/08/2025

0.28

2.00

8.03

NA

NA

NA

NA

NA

NA

11.19

Abakkus Personalised Opportunity Specific Strategy

24/09/2020

1487.16

1.97

4.45

0.57

-1.47

15.47

19.60

16.29

32.26

39.29

ALL WEATHER

11/06/2021

212.02

1.97

7.41

8.33

7.74

11.57

20.01

15.73

NA

15.65

UpperCrust Wealth Fund

20/01/2022

113.98

1.94

2.15

-2.79

2.60

20.45

26.77

NA

NA

15.77

SEVEN ISLANDS MULTICAP FUND

05/01/2023

150.40

1.93

3.90

0.85

-6.04

13.74

NA

NA

NA

24.45

Focused Opportunities Strategy

05/05/2014

64.33

1.89

6.28

-1.09

-9.26

16.54

27.23

22.30

28.33

19.30

BB Micro-Mega

22/01/2025

55.08

1.86

2.40

3.15

NA

NA

NA

NA

NA

18.02

Motilal Oswal Hockey Stick Large Cap Portfolio

04/01/2024

12.71

1.86

10.90

8.97

22.37

NA

NA

NA

NA

27.56

Profit Mantra

10/08/2021

27.40

1.86

10.41

11.47

9.45

24.38

25.64

21.96

NA

21.74

All Cap Strategy

30/08/2016

1268.45

1.85

8.09

0.96

5.48

12.71

21.94

13.33

22.34

16.83

ICICI Prudential PMS Value Strategy

28/01/2004

1018.16

1.81

6.86

7.06

10.10

15.77

25.59

25.32

25.94

13.31

BeSpokeEquity

19/07/2022

89.66

1.80

9.21

7.42

14.69

15.14

17.12

NA

NA

18.30

Flexi-cap Fundamental Opportunities

03/07/2023

91.45

1.79

9.76

7.85

14.69

13.27

NA

NA

NA

18.43

ALPHABETS

22/06/2016

21.15

1.74

6.42

2.22

-3.13

9.19

18.22

12.03

16.48

12.20

LONG HERITAGE VALUE FUND

03/03/2025

190.90

1.72

1.08

2.49

NA

NA

NA

NA

NA

18.01

BADJATE GROWTH FUND

23/05/2025

24.28

1.69

4.01

-5.34

NA

NA

NA

NA

NA

-0.29

Capital 8 Infinity Fund

02/02/2024

130.99

1.66

1.74

0.04

4.24

NA

NA

NA

NA

21.08

Tata PMS ACT Investment Approach

12/02/2019

99.76

1.66

1.83

-4.31

-2.69

6.30

12.60

9.91

13.57

12.92

Compass TrueNorth Portfolio

11/09/2025

0.11

1.65

6.30

NA

NA

NA

NA

NA

NA

6.02

GLC Growth Fund

08/12/2017

1274.11

1.61

3.40

-0.76

1.83

22.08

40.16

33.52

43.07

23.36

Sankhya India Portfolio

17/10/2017

153.20

1.59

5.54

0.90

2.55

5.82

14.59

10.31

13.82

14.22

CENTRUM FLEXICAP PORTFOLIO T NRI.

05/01/2022

1.64

1.57

7.43

2.48

8.54

16.47

20.93

NA

NA

13.16

SPARK INDIA 75 ACTIVE ALPHA STRATEGY

29/07/2023

224.94

1.55

8.19

2.32

10.76

8.75

NA

NA

NA

15.12

Trivantage Capital Small & Mid Cap Financials Portfolio

01/03/2023

27.19

1.54

11.34

-0.34

9.89

11.42

NA

NA

NA

20.38

Care PMS Large & Midcap

03/07/2020

51.30

1.52

4.13

4.75

12.03

15.84

27.05

20.09

20.90

23.14

ICICI Prudential PMS Infrastructure Strategy

26/12/2003

67.45

1.44

3.82

6.31

9.16

22.78

32.78

29.11

34.03

16.00

PriceBridge Upswing

12/12/2022

215.89

1.44

3.73

2.57

5.53

6.63

13.64

NA

NA

13.32

360 ONE Open - Managed Solutions Global Equity

20/09/2021

8.99

1.42

3.74

19.78

21.44

25.58

25.67

14.70

NA

14.69

Optimiser Mid & small Cap

25/11/2021

12.75

1.41

10.58

1.66

-5.39

7.62

27.03

19.44

NA

20.43

Alchemy Smart Alpha 250

10/08/2023

673.29

1.39

8.05

-2.90

-3.42

12.75

NA

NA

NA

20.31

ASK CONVICTION PORTFOLIO

07/05/2014

404.86

1.36

5.98

-2.32

-9.16

6.62

12.35

7.15

13.12

17.66

Omni Rail & Mobility

03/11/2025

0.03

1.35

NA

NA

NA

NA

NA

NA

NA

-4.09

CENTRUM FLEXICAP PORTFOLIO T

26/10/2021

56.55

1.34

6.54

2.37

9.82

12.33

18.37

11.83

NA

10.88

PATERSON ADVANTAGE

01/06/2024

3.33

1.34

5.95

-0.79

-8.08

NA

NA

NA

NA

1.00

Shree Vriddhi

02/05/2022

70.88

1.30

3.43

-5.03

-18.43

-5.11

10.63

NA

NA

10.13

ICICI Prudential PMS Prime Strategy

10/11/2023

728.62

1.26

5.03

5.24

8.52

23.84

NA

NA

NA

28.58

Abakkus All Cap Approach

29/10/2020

7710.23

1.25

8.35

5.29

11.14

12.31

19.77

14.10

23.79

25.41

KUNVARJI FINSTOCK PRIVATE LIMITED

15/09/2019

2.24

1.24

4.72

1.23

3.78

5.20

7.83

4.13

7.18

11.21

DIVERSIFIED MULTICAP

23/06/2021

100.74

1.23

5.12

6.99

6.99

11.16

21.80

16.95

NA

18.25

360 ONE Phoenix Portfolio

28/01/2021

1881.91

1.22

6.99

2.27

6.97

12.84

21.16

17.80

NA

19.95

SPARK INDIA@75 CORE AND SATELLITE STRATEGY

20/06/2019

370.70

1.22

7.61

0.57

6.71

8.08

18.36

17.84

20.55

19.88

CORE EQUITY

05/08/2022

11.03

1.18

7.48

6.71

2.93

9.30

14.11

NA

NA

12.41

ASK SPECIALISED PORTFOLIO

23/06/2003

422.90

1.17

5.80

-2.59

-8.04

5.93

12.86

7.42

12.61

16.45

INVASSET PRIME FUND

14/02/2025

1.62

1.17

1.82

-6.21

NA

NA

NA

NA

NA

9.69

Multicap PMS Series/1/2025

21/08/2025

10.40

1.17

2.45

NA

NA

NA

NA

NA

NA

3.46

Valtrust Equity Funds

31/03/2023

1.67

1.13

5.23

5.89

8.87

15.54

NA

NA

NA

24.95

IIFL Bluechip Alpha Portfolio

14/05/2025

203.71

1.10

8.99

6.75

NA

NA

NA

NA

NA

9.74

Enam India Diversified Equity Advantage Portfolio

30/05/2011

3443.72

1.09

5.88

4.63

3.64

8.03

12.30

10.65

15.26

15.66

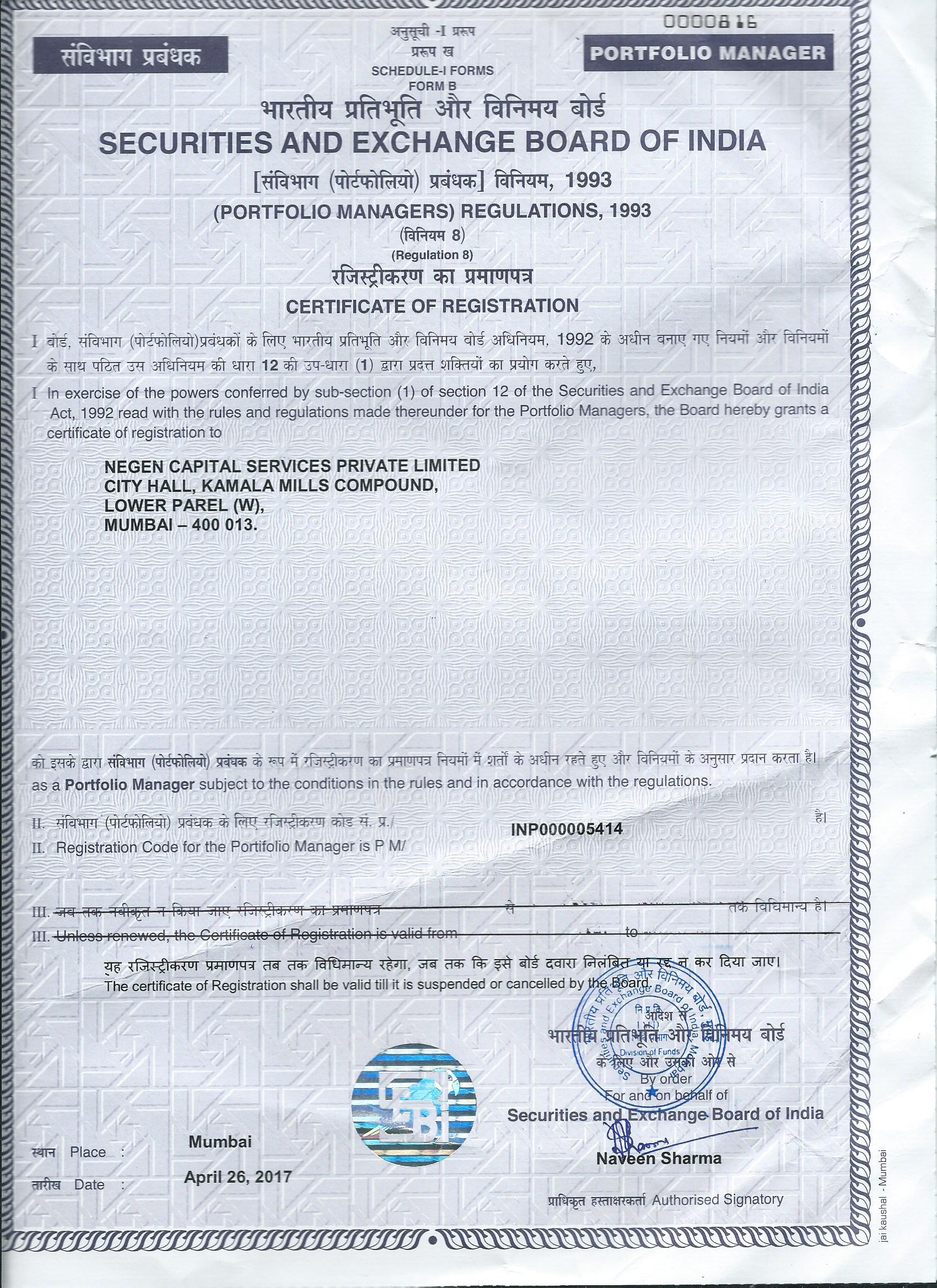

Negen Capital Services Private Limited

10/08/2017

1304.10

1.06

1.73

-5.87

0.08

15.38

26.84

19.19

29.82

17.92

India Ultra-Focussed Mid-Cap Growth Portfolio Series II (A2)

11/12/2015

23.32

1.04

8.21

8.89

11.85

16.43

23.56

19.22

24.70

14.89

Tata PMS Emerging Opportunities Investment Approach

04/04/2006

18.23

1.03

1.47

-0.70

-1.94

8.49

17.31

12.44

15.58

11.71

Nirmal Bang Equity Multi Cap

30/10/2023

163.82

1.02

2.05

-2.83

0.28

9.08

NA

NA

NA

16.04

Alchemy Smart Alpha Micro & Small cap

06/12/2023

42.15

1.01

4.01

-0.01

-15.93

7.32

NA

NA

NA

7.20

Capitalmind Resilient

06/09/2021

3.39

1.01

0.98

-6.21

-10.55

-3.99

6.14

5.11

NA

3.98

INVASSET LEADERS FUND

14/02/2025

3.51

1.01

1.12

-6.25

NA

NA

NA

NA

NA

13.08

Alchemy Alpha 100

16/08/2023

17.22

1.00

8.26

3.29

8.76

10.01

NA

NA

NA

15.16

SRE Small Cap Momentum PMS

28/11/2023

0.68

1.00

1.06

-7.71

-19.70

3.09

NA

NA

NA

4.00

INDEXALPHA

01/08/2019

13.24

0.99

6.31

7.38

13.90

11.87

13.01

8.93

9.25

6.78

UNICORN Flexi Cap Quant Portfolio

02/09/2025

0.75

0.99

3.09

NA

NA

NA

NA

NA

NA

-0.41

ICICI Prudential PMS Emerging Leaders Strategy

20/02/2024

170.21

0.98

4.76

5.73

7.26

NA

NA

NA

NA

10.95

ICICI Prudential PMS India Recovery Strategy

31/01/2019

47.58

0.97

3.43

4.48

5.24

23.22

32.40

33.74

39.04

30.51

Chanakya Multi-Cap

13/08/2018

318.42

0.96

9.03

3.95

17.89

15.46

21.31

19.63

22.80

16.50

Abakkus Diversified Alpha Approach

16/01/2024

1258.27

0.95

7.32

2.32

7.67

NA

NA

NA

NA

10.71

Axis Pure Contra Portfolio

26/11/2025

9.19

0.95

NA

NA

NA

NA

NA

NA

NA

-0.29

Adaptive Momentum

05/03/2019

407.25

0.93

2.71

-5.24

-15.40

-0.36

12.29

7.91

16.26

18.43

GROWTH

16/05/2014

19.23

0.93

2.89

-5.56

-14.23

6.66

19.13

13.17

23.71

19.37

Kotak Equity Portfolio Investment Approach

22/04/2022

1.04

0.93

6.75

0.63

5.18

12.26

16.77

NA

NA

17.20

Renaissance Opportunities Portfolio

01/01/2018

643.19

0.93

6.59

0.11

1.64

12.54

17.20

15.29

19.28

12.72

AIAlpha Dynamic Equity Portfolio

28/08/2025

1.99

0.92

4.79

NA

NA

NA

NA

NA

NA

5.09

INVASSET GROWTH FUND

08/01/2020

336.36

0.92

1.39

-5.32

-0.72

7.52

31.47

21.79

26.49

28.00

Motilal Oswal Hockey Stick Micro Cap Portfolio

29/08/2024

3.42

0.92

-1.54

-5.15

0.00

NA

NA

NA

NA

4.57

Flexi-Cap Wealth Creator Portfolio (A5)

13/11/2018

103.44

0.91

8.85

8.15

17.07

21.79

25.77

22.03

25.87

18.76

Enam India Equity Portfolio

08/07/2013

24131.95

0.89

6.35

2.94

3.94

10.09

16.13

13.99

17.63

18.36

Large Cap Opportunistic Portfolio Series I (A3)

24/03/2017

12.54

0.85

9.39

9.34

17.82

26.33

28.34

24.69

25.88

18.03

Motilal Oswal Multifactor Equity Strategy

09/04/2021

67.57

0.83

5.54

0.94

-0.14

9.40

20.68

11.49

NA

15.53

QODE ALL WEATHER

18/11/2024

118.04

0.83

6.46

10.76

27.73

NA

NA

NA

NA

23.44

GL Alpha Fund

13/02/2020

51.81

0.82

5.22

2.49

6.90

16.76

30.94

26.48

29.54

31.59

SPARK INDIA@75 FLEXICAP STRATEGY

07/02/2019

482.20

0.81

8.15

1.44

9.76

10.40

20.15

18.37

19.27

17.35

Ametra FactorShields PMS

16/10/2024

4.87

0.80

1.49

1.55

-0.25

NA

NA

NA

NA

-2.91

ICICI Prudential PMS Contra Strategy

14/09/2018

13043.33

0.80

4.26

3.56

10.41

14.42

20.85

20.65

23.60

19.59

BONANZA PULSE SECTOR FUND

02/02/2025

5.17

0.79

3.23

0.39

NA

NA

NA

NA

NA

9.26

FORTUNA ONE

04/07/2023

61.69

0.79

-2.35

6.48

14.11

25.07

NA

NA

NA

30.32

Ambit Good & Clean MidCap Portfolio

12/03/2015

438.95

0.78

7.56

0.77

-4.58

8.34

15.70

11.46

14.78

12.54

Q India Value Equity Strategy - Constrained V

17/12/2008

19453.43

0.77

6.19

2.39

6.41

14.53

18.50

15.50

17.35

17.19

Renaissance Platinum Portfolio

20/11/2020

144.02

0.76

4.08

0.44

-1.45

13.46

21.79

17.27

19.21

19.66

BONANZA VALUE

19/12/2013

29.76

0.75

-3.38

-7.95

-14.17

3.86

17.18

12.40

17.25

18.25

ALPHA

13/08/2021

382.37

0.74

4.17

2.93

10.09

11.09

21.35

22.79

NA

21.63

Trend Following - Flexicap Growth

01/04/2023

385.36

0.74

8.20

1.79

-4.03

8.66

NA

NA

NA

22.22

360 ONE Multicap PMS

07/11/2013

3488.78

0.73

3.57

-2.22

3.01

8.74

13.89

9.84

13.90

20.49

Abakkus All Cap (Shariah) Approach

01/04/2022

13.68

0.72

2.30

-1.24

-6.61

7.11

20.23

NA

NA

13.57

Enam India Vision Portfolio

17/01/2023

832.42

0.69

5.54

4.28

5.87

7.75

NA

NA

NA

14.90

EMKAY GEMS NRI

01/02/2020

1.89

0.68

6.06

0.00

5.49

7.29

16.41

13.41

15.61

12.11

EMKAYS 12

01/05/2019

12.52

0.66

5.94

1.41

10.03

9.00

13.71

9.74

11.73

12.45

Sohum India Focus 10 Investment Approach

04/10/2023

22.50

0.66

7.92

8.47

12.03

25.69

NA

NA

NA

29.27

ICICI Prudential PMS Growth Leaders Shariah Strategy

21/10/2022

61.21

0.65

4.71

4.23

3.92

15.38

22.04

NA

NA

21.85

BB All-Seasons

13/02/2025

65.84

0.64

2.80

3.07

NA

NA

NA

NA

NA

12.13

CARNELIAN CONTRA PORTFOLIO STRATEGY

27/01/2022

124.60

0.64

5.53

0.49

0.16

14.01

31.90

NA

NA

27.87

Trivantage Capital Resurgent Financials Equity Portfolio

17/02/2016

23.01

0.64

8.16

-0.78

11.62

8.94

11.63

10.91

11.51

12.58

dezerv. Arbitrage Strategy

05/06/2023

254.85

0.62

1.71

3.08

6.82

7.36

NA

NA

NA

7.35

Smallcap High Growth Low Valuation

09/01/2024

45.19

0.62

0.59

-5.36

-24.85

NA

NA

NA

NA

-1.42

STRUCTURED PRODUCT SERIES I

12/03/2010

0.01

0.62

0.62

1.24

2.65

2.80

2.86

-152.88

-109.74

-149.12

Val-Q Large Cap Blue Chip Fund

24/12/2014

48.72

0.62

5.14

6.37

15.22

11.58

16.02

13.46

14.98

10.86

Value Driven Approach

26/10/2007

1193.06

0.62

3.31

1.58

6.88

10.63

21.67

19.15

20.86

16.92

Custom Portfolio 22

16/11/2023

16.05

0.60

1.66

3.03

6.68

6.56

NA

NA

NA

6.56

Q India Value Equity Strategy - Constrained XVII

06/01/2025

9.47

0.60

2.84

0.44

NA

NA

NA

NA

NA

6.27

Value for Growth

02/08/2021

30.41

0.60

4.60

0.82

2.59

12.82

22.43

17.53

NA

15.25

CM Flexi Cap Strategy

06/08/2025

166.51

0.58

6.60

NA

NA

NA

NA

NA

NA

4.07

Girik BluFIN Strategy

17/01/2022

119.82

0.57

0.98

-5.24

-17.08

5.40

20.58

NA

NA

7.84

Invesco India R.I.S.E Portfolio

18/04/2016

353.07

0.57

7.21

5.35

13.29

14.45

20.96

16.90

17.97

14.45

Acepro Galaxy Strategy

13/07/2018

0.39

0.56

2.05

0.56

-5.46

2.13

4.80

4.12

7.41

3.98

APRICUS WEALTH STERLING EQUITY STRATEGY

05/03/2025

40.53

0.56

5.88

4.63

NA

NA

NA

NA

NA

6.05

ICICI Prudential PMS Largecap Strategy

16/03/2009

910.09

0.55

5.25

3.15

11.26

15.92

20.99

18.47

21.31

16.42

SilverArch India Equity Portfolio

04/09/2017

45.15

0.54

3.45

-4.32

-4.75

10.85

22.71

13.86

19.73

12.33

East Lane Long Term Growth

18/12/2020

965.63

0.53

4.03

3.18

3.07

13.03

15.87

11.50

15.36

15.35

BLUECHIP

18/07/2018

258.00

0.52

4.37

2.05

6.57

8.30

13.57

10.20

12.33

10.96

Mega Trends - Multicap Growth

18/09/2017

127.00

0.52

7.42

1.01

-4.97

6.34

16.14

9.17

12.73

10.21

AXIS SECURITIES PURE LIQUID G

19/07/2023

1.81

0.51

1.43

2.77

6.90

6.59

NA

NA

NA

6.55

Customised Discretionary Portfolio - Equity

15/10/2014

18856.00

0.51

5.26

1.29

6.76

13.43

18.46

12.59

15.07

-0.19

Electrum S.C.A.L.E.

27/11/2024

4.36

0.51

6.53

-1.12

0.82

NA

NA

NA

NA

-0.66

ICICI Prudential PMS PIPE Strategy

05/09/2019

7144.08

0.51

2.43

1.91

0.95

13.11

25.59

24.26

28.84

26.38

360 ONE Multicap Advantage PMS

05/12/2017

1.40

0.48

6.27

3.38

7.38

11.08

14.65

9.76

13.29

11.32

AXIS SECURITIES PURE LIQUID C

19/07/2023

3.02

0.48

1.29

2.47

6.54

6.48

NA

NA

NA

6.42

Q India Value Equity Strategy - Constrained XIX

01/02/2025

701.00

0.48

4.22

1.14

NA

NA

NA

NA

NA

7.07

Ambit CALIBER Portfolio - STP

18/07/2022

5.78

0.46

7.45

3.36

5.48

13.60

19.43

NA

NA

16.82

Wallfort KOSH Value Fund

01/07/2024

4.94

0.46

-0.65

-8.00

-13.40

NA

NA

NA

NA

-9.64

DELTA FUND

01/06/2024

19.78

0.45

3.24

2.56

3.46

NA

NA

NA

NA

0.82

Trivantage Capital Focussed Corporate Lenders Portfolio

10/12/2018

2.52

0.45

9.80

2.63

14.24

5.61

8.12

10.63

10.29

7.51

Ambit CALIBER Portfolio

02/02/2021

100.39

0.44

7.20

3.53

6.20

14.47

19.26

8.67

NA

15.81

Abakkus Emerging Opportunities Approach

26/08/2020

5828.58

0.42

4.14

-2.07

-2.94

12.15

24.21

16.30

27.02

29.11

ALPHA ALTERNATIVES FUND ADVISORS LLP PMS SYSTEMATIC EQUITY

15/06/2021

141.30

0.42

-1.87

-10.55

-10.25

9.05

16.30

9.89

NA

12.99

AXIS SECURITIES PURE LIQUID K

19/01/2024

0.56

0.42

1.26

2.60

6.79

NA

NA

NA

NA

6.23

IME Concentrated Microtrends

01/10/2025

41.75

0.42

6.99

NA

NA

NA

NA

NA

NA

6.99

Q India Value Equity Strategy - Constrained XVIII

20/01/2025

88.42

0.42

3.57

1.57

NA

NA

NA

NA

NA

2.67

MULTICAP PORTFOLIO

02/04/2016

729.11

0.40

6.39

-0.73

-2.01

12.46

23.74

14.68

23.08

14.93

ALGROW

25/11/2020

2.88

0.39

-6.78

-12.92

-16.38

-7.68

1.94

4.03

0.00

7.01

ALPHA COMPOUNDERS

07/11/2022

33.93

0.39

2.77

-3.33

3.63

14.17

19.30

NA

NA

17.55

Maxiom PMS - DIAMOND Diversified Mutual Funds Retirement Planning

01/04/2025

1.45

0.38

3.18

3.05

NA

NA

NA

NA

NA

8.49

First Global India Super 50 (FG-IS50)

18/02/2020

262.86

0.37

2.49

-0.85

-3.16

3.93

13.07

8.01

16.29

18.96

Sterling Portfolio- Growth Portfolio

18/11/2022

103.95

0.37

5.22

3.80

9.72

14.32

17.69

NA

NA

16.51

ABC Equity Portfolio

28/01/2021

145.78

0.36

4.22

1.92

5.95

7.47

16.28

16.05

NA

17.21

Citrus Wealth Fusion Fund

20/05/2025

3.77

0.36

5.58

4.53

NA

NA

NA

NA

NA

7.68

Abakkus Curated Personalized Portfolio Strategy

01/09/2023

121.00

0.34

-1.61

-6.15

-13.61

23.99

NA

NA

NA

23.22

HIGH RISER

09/09/2014

19.22

0.33

3.20

-6.16

-11.68

8.14

20.26

13.79

24.45

18.95

Sterling Portfolio- Aggressive Portfolio

11/11/2022

315.44

0.33

5.88

4.45

11.52

16.18

20.61

NA

NA

19.43

Ionic Navigator Portfolio

05/06/2025

0.07

0.32

2.51

-7.46

NA

NA

NA

NA

NA

-5.10

Ionic Navigator Portfolio-Midcap

05/06/2025

0.07

0.32

2.51

-7.56

NA

NA

NA

NA

NA

-6.28

IDPL Wealthy Nivesh Multi Asset

26/11/2025

1.51

0.31

NA

NA

NA

NA

NA

NA

NA

0.29

Renaissance Sterling Portfolio

07/10/2025

10.09

0.31

NA

NA

NA

NA

NA

NA

NA

5.93

Q India Value Equity Strategy

27/06/2000

10.75

0.30

4.04

0.56

3.57

12.15

16.72

14.19

16.10

15.61

ICICI Prudential PMS SMART Strategy

22/10/2014

99.65

0.29

6.93

4.44

7.45

17.01

24.86

23.51

24.54

15.30

Legend Jain

23/02/2016

1.52

0.29

4.80

-1.68

2.77

7.12

11.53

7.20

11.81

10.71

Bloom

03/05/2024

6.54

0.28

6.65

7.66

24.61

NA

NA

NA

NA

24.33

Elevate

25/04/2025

92.18

0.28

-4.00

-2.59

NA

NA

NA

NA

NA

4.66

Select Direct Growth Portfolio

20/01/2020

118.01

0.28

5.82

6.54

13.97

15.20

20.56

15.66

18.55

18.88

2Point2 Long Term Value Fund

20/07/2016

1791.01

0.27

8.40

-0.78

23.40

14.83

24.98

20.36

22.57

20.39

Ambit CALIBER H Portfolio

22/02/2021

10.59

0.27

6.74

1.82

4.13

13.44

18.72

8.11

NA

14.65

KSEMA WEALTH MULTICAP - INDIA OPPORTUNITIES FUND

28/01/2019

80.44

0.27

4.62

-0.79

6.09

10.44

18.04

15.18

20.37

18.78

SAHASRAR CONCENTRATED GROWTH PORTFOLIO

20/06/2022

1297.26

0.27

1.43

3.15

16.00

38.91

32.43

NA

NA

26.63

Omni Barons

03/11/2025

0.02

0.24

NA

NA

NA

NA

NA

NA

NA

-1.88

AXIS SECURITIES CUSTOMISED

04/03/2020

582.42

0.23

1.79

-3.64

-0.57

11.48

18.19

14.15

15.70

16.31

DB India Multicap Equities / Long-term capital growth

20/08/2020

279.47

0.23

8.58

6.43

10.37

14.86

17.88

12.98

16.65

18.34

ICICI Prudential PMS T.I.M.E Strategy

12/09/2019

62.67

0.22

4.56

3.13

5.58

15.38

25.15

24.55

26.29

25.73

LATENT EQUITY GROWTH

18/01/2024

77.80

0.22

3.63

-2.22

8.93

NA

NA

NA

NA

24.79

EMKAY GEMS

01/02/2020

13.59

0.21

7.29

0.17

3.98

6.47

16.00

11.59

15.61

18.28

ESCORP ASSET MANAGEMENT LTD

22/09/2017

6.85

0.21

3.65

0.20

6.48

2.72

9.59

22.59

29.66

20.71

Active Index Portfolio

22/04/2019

103.31

0.20

5.62

1.43

1.68

9.67

18.40

12.50

15.52

13.72

ICICI Prudential PMS Quanti-FI Strategy

02/02/2024

44.19

0.19

5.93

3.58

5.57

NA

NA

NA

NA

8.22

Kotak India Focus Portfolio Investment Approach

03/07/2012

790.21

0.18

6.87

3.72

5.61

16.17

21.62

14.46

22.43

15.55

Roha Titans Equity Portfolio

19/08/2025

0.49

0.18

2.93

NA

NA

NA

NA

NA

NA

-1.43

CENTRUM GOOD TO GREAT NRI.

14/08/2019

15.72

0.16

0.86

-6.90

-10.40

6.55

13.39

5.84

14.42

16.06

Custom portfolio 19

10/06/2022

22.66

0.16

4.29

-1.59

9.46

5.61

10.60

NA

NA

13.32

Maxiom PMS - JEWEL Flexi Cap Quality-Growth

23/06/2023

66.18

0.14

3.32

-0.53

6.18

6.31

NA

NA

NA

8.30

Valcreate Lifesciences & speciality opportunities

10/02/2023

14.86

0.14

0.94

-7.03

-4.23

10.81

NA

NA

NA

14.26

Alphaa factor Investing Fund

04/06/2024

27.12

0.13

6.48

3.40

11.11

NA

NA

NA

NA

-7.82

ICICI Prudential PMS Enterprising India Strategy

04/02/2015

4.02

0.13

5.64

2.25

7.54

4.90

13.47

14.37

18.40

11.02

India Portfolio Builder

01/01/2016

8.56

0.13

6.33

6.90

8.71

10.85

15.52

13.96

16.88

10.84

Abakkus Emerging Opportunities (Shariah) Approach

16/06/2023

13.52

0.11

-0.26

-6.34

-13.00

10.42

NA

NA

NA

18.60

PRUDENCE

11/05/2016

1604.47

0.11

-0.01

-3.49

3.03

11.82

12.60

7.02

13.40

16.33

Alphaa MPT Plus Fund

08/09/2023

6.18

0.09

3.56

0.88

10.80

16.07

NA

NA

NA

17.61

CENTRUM GOOD TO GREAT PORTFOLIO.

03/06/2019

102.86

0.09

0.61

-6.94

-11.54

6.01

13.58

5.97

15.22

17.57

EquiPoise Emerging Stars

28/08/2024

8.26

0.09

-0.75

-6.52

-5.62

NA

NA

NA

NA

-6.54

UNICORN STAR PORTFOLIO

07/10/2024

32.71

0.09

2.33

-3.73

-0.87

NA

NA

NA

NA

-5.95

ICICI Prudential PMS Multi-Manager - Thematic Strategy

30/11/2018

72.63

0.08

4.21

1.33

8.08

13.68

18.69

15.40

18.77

18.60

Wallfort Ameya Fund

07/12/2022

107.24

0.08

-2.94

-8.92

-14.94

10.37

0.00

NA

NA

35.59

Approach 2 Elite Value

01/04/2010

18.02

0.07

8.96

10.65

15.72

14.38

17.02

13.92

19.28

32.70

360 ONE Mandate - Equity

05/07/2019

1409.30

0.06

6.20

2.55

9.09

12.26

16.25

12.37

12.83

15.52

CENTRUM FLEXICAP NRI.

24/01/2012

11.90

0.05

4.69

2.80

11.58

13.26

19.42

10.88

16.62

11.80

Alphagen

31/12/2015

48.45

0.04

4.51

0.39

-3.30

8.38

16.25

10.01

13.73

13.87

Ambit Micro Marvels Portfolio

29/07/2024

348.33

0.04

-5.53

-10.09

-17.82

NA

NA

NA

NA

-13.26

Buoyant Opportunities PMS

31/05/2016

8019.43

0.03

7.11

5.19

16.59

17.67

24.79

19.01

27.72

21.94

PicoPower

10/10/2011

433.12

0.03

-0.18

-4.62

-8.49

9.81

20.31

11.88

21.59

22.84

AAA Couture Portfolio

13/09/2023

202.14

0.02

4.04

6.21

3.78

15.04

NA

NA

NA

16.36

Centrum String of Pearls DV- III

10/02/2015

9.44

0.02

-0.28

-7.96

-14.52

4.49

12.62

5.09

14.33

12.91

Custom portfolio 2

03/04/2019

0.76

0.02

4.22

19.22

6.98

28.72

34.78

16.40

18.50

23.83

GREEN PORTFOLIO DIVIDEND YIELD FUND

23/09/2019

26.70

0.02

1.53

3.84

7.48

14.79

30.77

24.31

29.98

30.16

Ionic Allocate Portfolio-Equity

21/03/2025

50.56

0.02

3.40

5.09

NA

NA

NA

NA

NA

10.76

Prosperity Fund of Funds

28/11/2023

11.82

0.02

1.44

1.33

5.64

10.10

NA

NA

NA

13.13

TOP 100 Equity

03/01/2024

16.14

0.02

5.28

1.65

9.52

NA

NA

NA

NA

9.47

ADAPT PORTFOLIO - Very Agressive

24/06/2010

21.90

0.01

3.01

3.05

10.66

12.67

19.13

13.32

14.59

12.27

ASK CORE PORTFOLIO

23/07/2025

100.94

0.01

6.30

NA

NA

NA

NA

NA

NA

5.79

QUANT

01/08/2008

59.23

0.01

6.57

4.08

8.00

8.22

11.16

9.49

11.67

9.00

Sohum India Opportunities Investment Approach

15/12/2023

67.38

0.01

6.77

5.34

11.83

15.61

NA

NA

NA

16.68

360 ONE Large Value strategy PMS

25/04/2024

843.12

0.00

-0.70

-12.43

25.03

NA

NA

NA

NA

79.38

Abakkus All Cap Approach 2

01/09/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

Abakkus Emerging Opportunities Approach 2

01/09/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

ABSL Next 100 Portfolio NR

31/12/2019

0.00

0.00

0.00

0.00

0.00

0.00

1.70

0.34

6.26

7.19

ADITYA BIRLA MONEY LTD R B P RULE BASED PORTFOLIO

19/10/2022

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

0.00

Aggressive Leaders

07/01/2021

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

0.00

All Cap (ESG) Approach

01/04/2022

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

0.00

ALPHA MUTUAL F-of-F

01/03/2012

0.00

0.00

0.00

0.00

0.00

-0.01

6.18

5.85

7.97

12.75

Arthya ALL-STAR Multi-Cap Shariah Portfolio

23/03/2022

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

0.00

ARTHYA Core Portfolio

05/06/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Arthya Emerging Stars Portfolio

03/07/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

Arthya Leaders Portfolio

03/07/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

Arthya Multicap Portfolio

23/07/2021

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

0.00

Arthya Opportunities Portfolio

06/05/2022

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

0.00

ASK INDIA VISION PORTFOLIO STP

18/11/2019

0.00

0.00

0.00

-4.12

-8.25

-0.04

6.98

2.41

8.24

10.30

AXIS SECURITIES MF MAXIMIZER EQUITY

04/08/2021

0.00

0.00

0.00

0.00

0.00

-68.58

-50.60

-41.89

NA

-37.46

Bonanza Prima Fund-Moderate

22/12/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

CA MFM Large cap

22/02/2022

0.00

0.00

-10.88

-22.75

-18.70

-9.55

-2.28

NA

NA

-1.03

CA MFM MID CAP

17/04/2022

0.00

0.00

-10.02

-53.48

-51.40

-28.86

-13.60

NA

NA

-11.44

Conservative Growth

01/11/2021

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

0.00

Deep Value Portfolio

01/01/2008

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

1.70

3.30

Deep Value Strategy

16/01/2012

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

dezerv. Momentum Strategy

01/08/2024

0.00

0.00

5.71

-2.61

-14.40

NA

NA

NA

NA

-17.20

Discover Value Strategy

30/10/2006

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

EMERGING BUSINESS OPPORTUNITY PORTFOLIO - 1

01/02/2017

0.00

0.00

0.00

0.00

0.00

0.00

5.34

1.79

11.74

5.64

Emerging Sector Opportunity Portfolio

01/01/2008

0.00

0.00

0.00

0.00

0.00

0.00

47.14

32.66

31.46

11.06

EMKAY CAPITAL

01/04/2003

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

EMKAY PEARLS

24/11/2011

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Focused (Series V) A Contra Strategy

09/11/2011

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

ICICI Prudential PMS Enterprising India Strategy Series II

10/03/2017

0.00

0.00

0.00

0.00

-10.09

5.94

16.10

15.25

22.80

12.59

India Invest Opportunity Portfolio Strategy

21/03/2017

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

India Invest Opportunity Portfolio Strategy V2

22/02/2018

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

India Opportunity Portfolio Strategy

15/02/2010

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

India Opportunity Portfolio Strategy - V2

11/01/2018

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

JPMS AGILITY FUND

10/05/2021

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

0.00

JPMS BHARAT 5T

31/12/2019

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

JPMS BHARAT 5T DYNAMIC

22/12/2020

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

JPMS EXCELLENCE OF DAILY OBJECT

14/03/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

JPMS SAMURRAI- COFFEECAN

06/09/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

KRIIS COMPOUNDERS PORTFOLIO STRATEGY

16/01/2023

0.00

0.00

0.00

0.00

-5.25

23.51

NA

NA

NA

33.02

Large Cap Growth Strategy

22/02/2018

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Microsec Wealth Management Ltd.

29/09/2018

0.00

0.00

0.00

0.00

-6.36

6.43

15.62

8.36

12.86

13.43

MONEYCOMB

01/08/2007

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Motilal Oswal 25-for-25 Strategy

22/02/2021

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

0.00

Motilal Oswal All cap Growth Strategy

23/01/2019

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Motilal Oswal Business Opportunities Portfolio Strategy

18/12/2017

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Motilal Oswal Emerging Business Strategy

23/01/2019

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Motilal Oswal Emerging Stars Portfolio

04/01/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Motilal Oswal Hockey Stick Mid Cap Portfolio

04/01/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Motilal Oswal Hockey Stick Mini Cap Portfolio

29/08/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Motilal Oswal Hockey Stick Small Cap Portfolio

04/01/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Motilal Oswal Microcap Multifactor Strategy

01/08/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Motilal Oswal Mid and Smallcap Opportunities Strategy

23/01/2019

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Motilal Oswal Multicap Opportunities Strategy

22/01/2019

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NAFA Pharma Portfolio

24/08/2020

0.00

0.00

0.00

0.00

0.00

0.00

0.00

-7.83

-3.51

-1.04

Neo Club - Equity Advantage Product

02/01/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

Neo Club - Multi Asset Investment Product

02/01/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

OAKS Co-investment Portfolio

24/01/2022

74.17

0.00

-0.46

-0.95

5.66

2.02

0.76

NA

NA

0.61

PGIM INDIA EQUITY PORTFOLIO SERIES I High Conviction Themes

28/06/2023

5.91

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

-1.04

Phillip Multi Asset Portfolio

12/08/2022

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

0.00

PLUS strategy

09/11/2011

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

PMS MOPE I

26/04/2018

222.84

0.00

1.19

6.20

9.36

10.16

7.72

4.71

5.15

3.93

Prudent Growth Opportunities

13/03/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

Sanctum FinEdge

04/08/2021

0.00

0.00

0.00

0.00

0.00

-0.96

4.65

4.62

NA

3.50

SilverArch India Mid & Small Cap Equity Portfolio

05/02/2018

0.00

0.00

0.00

0.00

0.00

14.05

23.88

15.82

23.40

12.03

STEPTRADE RISING STAR FUND

09/02/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

STEPTRADE SME FUND

09/02/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

STRUCTERED PRODUCT SERIES VIII

26/04/2013

1.87

0.00

0.00

0.55

0.55

0.28

0.82

0.61

0.49

0.08

TAMOHARA FAMILY OFFICE SERIES VI

21/12/2018

0.00

0.00

0.00

0.00

-17.47

-6.68

1.71

3.07

3.07

2.32

Trend Following -Large Cap

02/12/2024

0.00

0.00

0.00

0.00

-10.93

NA

NA

NA

NA

-8.22

ValPro Conserve (C) PMS

15/04/2021

0.00

0.00

0.00

-4.66

1.20

6.62

13.91

7.04

NA

6.54

VEDARTHA NEO EQUITY PORTFOLIO

11/07/2017

0.00

0.00

2.79

-1.24

-0.44

6.58

12.51

7.92

11.18

8.97

Ventura Micro Cap Thematic Portfolio Management Scheme

01/08/2022

0.00

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

0.00

WhiteOak Capital Bharat 100 Portfolio Approach

29/04/2024

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

NA

0.00

WhiteOak Capital Emerging Leaders Portfolio Approach

27/02/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

WhiteOak Capital Family-Owned Family Managed Portfolio (FOFM) Approach

20/02/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

WhiteOak Capital Select Stocks Portfolio Approach

08/08/2023

0.00

0.00

0.00

0.00

0.00

0.00

NA

NA

NA

0.00

AXIS SECURITIES GROWAN

24/06/2021

10.10

-0.02

2.15

-1.86

0.28

11.06

17.69

14.94

NA

16.18

BADJATE MULTICAP FUND

08/07/2021

151.56

-0.02

-0.18

-7.68

-15.71

13.50

28.92

19.12

NA

19.26

MAS Prime

02/12/2019

105.52

-0.02

-2.81

-5.94

-5.00

11.95

18.96

13.74

14.34

15.59

Banyan Leaders Portfolio

20/03/2024

20.38

-0.03

8.90

7.62

8.91

NA

NA

NA

NA

16.18

India Ascent Portfolio - DPMS

16/06/2023

3.28

-0.03

4.89

-1.26

-2.11

8.94

NA

NA

NA

12.74

AXIS SECURITIES PURE GROWTH

13/01/2021

982.44

-0.04

2.32

-1.32

0.98

10.91

18.53

16.00

NA

17.96

INDIA LARGE CAP QUANT EQUITY PORTFOLIO

17/03/2009

0.35

-0.04

6.19

2.53

7.49

6.56

12.37

8.53

10.01

12.47

Moats and Special Situations Portfolio

27/01/2011

764.14

-0.05

4.45

1.39

13.19

13.53

17.60

15.06

14.88

14.94

360 ONE Open - Enhancer Series - Blended Equity Enhancer

19/07/2024

72.22

-0.06

5.79

1.54

6.82

NA

NA

NA

NA

2.83

Ultima Select

05/05/2023

10.50

-0.06

6.06

3.36

10.92

10.18

NA

NA

NA

11.91

WEALTH GUARDIAN FUND

16/05/2023

157.04

-0.06

-2.03

-3.97

-3.14

8.06

NA

NA

NA

17.89

BCAD

27/04/2018

284.52

-0.07

3.35

-3.95

2.75

3.87

13.60

8.38

16.34

14.38

CENTRUM GOOD TO GREAT T

18/02/2020

111.35

-0.07

0.43

-7.51

-12.17

5.97

13.47

6.04

13.24

17.81

Nucleus "Equity" Multi-Cap Allocator

14/02/2023

50.74

-0.07

4.89

2.07

10.36

10.28

NA

NA

NA

13.80

ARDEKO GROWTH FUND

23/06/2025

138.64

-0.08

0.75

-1.43

NA

NA

NA

NA

NA

0.13

Nippon India Royal Portfolio

01/04/2004

3.38

-0.08

5.16

1.32

2.57

9.43

17.66

11.90

14.96

12.85

SPICE ROUTE VOYAGER

27/11/2024

12.70

-0.08

3.01

0.49

5.49

NA

NA

NA

NA

5.05

UNICORN GRORIGHT INDIA OPPORTUNITIES PORTFOLIO

24/03/2025

1.48

-0.08

1.68

-5.17

NA

NA

NA

NA

NA

0.02

360 ONE Open - Enhancer Series - Dynamic Passive Equity

13/10/2023

66.57

-0.09

6.30

1.39

5.27

9.39

NA

NA

NA

14.09

Alphaa Better Risk Reward 30 Stocks Portfolio

01/09/2023

7.51

-0.09

4.73

1.34

4.70

11.27

NA

NA

NA

16.01

AXIS SECURITIES SELECT NIFTY 50

04/07/2013

9.90

-0.09

4.43

4.32

15.99

12.83

14.56

12.28

14.26

12.50

Omni Energy Transition

03/11/2025

0.02

-0.09

NA

NA

NA

NA

NA

NA

NA

-7.15

AI Dynamic

30/09/2019

6.47

-0.10

6.90

2.57

-2.73

2.92

9.58

6.03

11.45

14.60

CENTRUM DEEP VALUE IV.

10/12/2015

24.33

-0.10

0.45

-7.27

-12.64

5.87

13.73

5.45

14.47

14.93

MAS Growth

18/12/2019

142.05

-0.10

-0.28

-4.44

-13.03

9.39

19.90

15.38

16.88

22.74

Renaissance India Next Portfolio

19/04/2018

898.03

-0.10

5.35

-1.49

0.45

15.40

19.78

20.40

28.59

15.44

CENTRUM DEEP VALUE IV NRI.

18/12/2015

0.88

-0.11

0.61

-7.83

-15.18

3.28

11.28

3.80

13.22

14.76

IME Bespoke Equity

01/10/2025

9.66

-0.12

5.86

NA

NA

NA

NA

NA

NA

5.86

Purnartha Pratham

17/09/2020

1603.65

-0.12

4.02

-4.32

-4.15

8.46

14.03

9.30

9.27

11.35

RH AlphaBots India Large Cap 30

31/03/2023

1.57

-0.12

5.62

1.83

3.63

5.15

NA

NA

NA

10.65

ALL WEATHER.

26/12/2019

15.69

-0.13

0.18

-9.00

-1.93

13.59

22.69

14.96

17.28

15.39

ICICI Prudential PMS Multi-Manager - Core Equity Strategy

23/06/2016

234.71

-0.13

4.51

2.56

10.19

11.82

16.70

15.01

17.41

13.90

Kotak India Focus Portfolio Investment Approach Customised

22/04/2015

7.57

-0.13

4.25

1.91

-12.09

2.20

12.07

9.25

15.64

8.99

360 ONE Open - Enhancer Series - Active Equity Enhancer

20/06/2024

42.94

-0.14

5.56

1.47

7.18

NA

NA

NA

NA

5.18

360 ONE Open - Managed Solutions All Equity

11/12/2019

125.87

-0.14

5.56

1.13

5.76

10.83

16.25

12.45

13.89

12.62

Maxiom PMS - CATALYST - Special Situations

01/06/2023

0.35

-0.14

-0.14

-0.14

-0.14

-0.14

NA

NA

NA

8.41

NAFA INDIA ALPHA FUND

12/11/2025

8.53

-0.14

NA

NA

NA

NA

NA

NA

NA

-0.77

Wright Alpha Fund

23/08/2023

51.06

-0.14

5.14

-7.85

-30.68

-6.56

NA

NA

NA

5.23

ASK FINANCIAL OPPORTUNITIES PORTFOLIO STP

01/11/2019

2.01

-0.15

11.95

2.85

15.63

15.54

15.90

11.61

12.46

12.39

Enam India Core Equity Portfolio

01/04/2001

8334.31

-0.15

4.79

0.78

0.12

6.51

13.47

11.95

16.96

19.15

EquiPoise New India Opportunities

06/08/2024

65.88

-0.15

1.11

-3.31

1.23

NA

NA

NA

NA

0.25

Bespoke Accounts

06/03/2006

111.53

-0.16

6.21

2.66

10.46

9.66

11.54

11.28

10.73

10.39

BONANZA MULTICAP

05/07/2018

12.06

-0.16

0.88

-7.19

-14.44

6.79

22.56

17.35

26.80

20.67

RH AlphaBots India 100

31/03/2023

7.14

-0.16

5.75

2.49

9.81

14.27

NA

NA

NA

13.20

Aqua Strategy

12/06/2023

384.01

-0.17

6.51

4.23

-1.09

8.37

NA

NA

NA

23.22

IKIGAI Bespoke Small Cap Strategy

07/11/2025

34.87

-0.17

NA

NA

NA

NA

NA

NA

NA

-1.11

ASK FINANCIAL OPPORTUNITIES PORTFOLIO

26/06/2018

200.80

-0.18

11.70

2.77

16.60

16.13

15.81

11.38

12.24

10.01

ASK INDIAN ENTREPRENEUR PORTFOLIO

25/01/2010

8937.76

-0.18

6.22

0.59

6.19

7.35

11.56

6.17

11.17

16.25

GENIUS

03/07/2024

9.18

-0.18

4.32

2.16

8.82

NA

NA

NA

NA

1.85

Omni Capital Creators

03/11/2025

0.03

-0.18

NA

NA

NA

NA

NA

NA

NA

-1.22

360 ONE Open - Enhancer Series - Passive Equity Enhancer

13/10/2023

205.98

-0.19

6.21

1.38

5.79

9.68

NA

NA

NA

14.08

AXIS SECURITIES PURE CONTRA

27/11/2020

2160.19

-0.20

0.68

-5.22

-3.37

11.79

20.06

17.38

21.12

21.69

Bonanza OPTIMA Strategy

01/07/2024

17.20

-0.20

4.11

2.64

2.50

NA

NA

NA

NA

3.53

Customised Portfolio Approach 6

26/04/2023

2.92

-0.20

8.37

1.65

16.59

10.14

NA

NA

NA

19.45

UNICORN MAX 10 PORTFOLIO

25/10/2024

0.49

-0.20

-0.39

-9.50

-12.57

NA

NA

NA

NA

-5.56

FORT DYNAMIC

03/01/2024

203.87

-0.21

7.37

7.75

17.88

NA

NA

NA

NA

23.55

Omni Captains

03/11/2025

0.03

-0.21

NA

NA

NA

NA

NA

NA

NA

-0.49

Infinity Core Equity Approach

18/06/2020

175.05

-0.22

5.54

3.32

7.00

9.33

16.40

11.16

13.83

18.53

Julius Baer Premier Focused Portfolio

24/02/2023

162.37

-0.23

7.75

4.39

8.59

12.70

NA

NA

NA

19.49

Karma Capital Lotus

22/02/2023

20.29

-0.23

5.36

3.64

11.05

16.81

NA

NA

NA

27.27

MINT

01/06/2014

0.00

-0.24

1.47

-3.89

2.32

11.23

17.55

11.55

18.11

17.73

NARNOLIA MID AND SMALL CAP STRATEGY

04/05/2015

142.32

-0.24

2.60

-3.13

-4.64

11.88

21.63

12.85

16.86

18.65

WEALTH SPIRAL ( DYNAMIC SCHEME) 2

01/01/2010

0.13

-0.24

1.87

-6.10

-18.27

-12.80

8.91

4.18

10.03

4.66

dezerv. Alpha Beta Equity Strategy

04/05/2022

35.02

-0.25

3.93

1.81

7.38

12.88

17.73

NA

NA

17.42

HDFC AMC "MF Select" Portfolio - Equity (Formerly Portfolio of MF Schemes/ETFs)

12/02/2007

22.66

-0.25

3.64

4.03

12.16

16.98

22.37

20.71

23.60

12.60

Index (Market)

05/03/2019

224.60

-0.25

4.71

2.10

6.61

14.89

19.49

13.25

16.03

15.93

ASK Wealth Core Equity

13/05/2024

53.30

-0.26

3.52

1.94

5.30

NA

NA

NA

NA

8.75

BB Curated Care

30/04/2025

0.56

-0.26

4.46

3.40

NA

NA

NA

NA

NA

8.10

Maxiom PMS-EMERALD-E Diversified Mutual Funds (Equity)

01/04/2025

8.78

-0.26

4.15

1.79

NA

NA

NA

NA

NA

8.04

SAMMAAN INDIA

18/08/2025

3.23

-0.26

-0.06

NA

NA

NA

NA

NA

NA

1.19

Structure Product Series 3 (Hero Electric)

04/08/2018

0.00

-0.26

-207.60

-206.78

-99.34

-91.97

-81.52

-71.95

-63.98

-50.78

TAMOHARA TRADE SANCHAY STRATEGY

19/01/2021

27.18

-0.26

5.56

3.64

8.31

14.00

13.77

9.27

NA

9.38

Aggressive Debt

25/01/2022

2.02

-0.27

1.91

5.31

10.82

11.03

7.72

NA

NA

5.99

Concept Legend

28/07/2009

23.31

-0.27

5.14

0.43

1.19

6.87

9.39

5.54

9.04

11.68

EIML CAPITAL

01/04/2003

467.21

-0.27

7.01

7.37

10.44

18.05

21.71

18.48

20.41

13.14

ICICI Prudential PMS Defined Tenure Series Strategy

10/05/2006

17.79

-0.27

5.28

4.00

10.15

14.76

19.16

17.80

20.96

15.10

Omni Amrit Kaal

03/11/2025

0.05

-0.27

NA

NA

NA

NA

NA

NA

NA

-3.75

Sowilo Target Agressive Scheme

23/06/2023

51.50

-0.27

-3.01

-6.89

-12.90

10.73

NA

NA

NA

17.91

NARNOLIA MULTI-ASSET STRATEGY

26/08/2019

33.74

-0.28

3.90

1.72

7.21

10.54

14.88

11.93

15.47

16.42

ASK INDIAN ENTREPRENEUR PORTFOLIO STP

14/10/2019

60.11

-0.29

6.19

0.43

5.64

6.47

10.84

5.73

10.66

12.88

AXIS SECURITIES CONTRARIAN

04/12/2020

15.39

-0.29

0.73

-5.07

-3.33

15.60

23.23

15.91

20.00

20.15

Concept Symphony

23/06/2025

0.82

-0.29

3.66

1.79

NA

NA

NA

NA

NA

1.79

ValPro Balanced (B) PMS

06/07/2021

3.90

-0.30

4.87

3.38

7.53

11.12

10.84

2.97

NA

3.77

AlphaaMoney Equity+ Portfolio

13/10/2023

0.75

-0.31

5.99

9.37

11.42

16.25

NA

NA

NA

20.39

Bluechip Equity FOF

07/06/2017

4.30

-0.31

5.17

2.16

9.17

10.46

16.67

13.51

16.04

12.97

dezerv. Equity Revival Strategy

14/06/2022

6089.60

-0.31

4.74

2.31

7.07

13.16

19.73

NA

NA

20.11

MULTICAP

05/10/2021

1.69

-0.31

-0.43

-4.19

5.16

5.99

9.81

6.03

NA

5.22

All Cap Portfolio - DPMS

27/07/2022

51.98

-0.32

2.90

0.61

4.73

12.01

16.97

NA

NA

17.05

Bonanza Prima Fund-Conservative

03/03/2024

1.21

-0.33

3.72

3.61

4.67

NA

NA

NA

NA

9.46

Diversified Portfolio - Equity

20/09/2001

593.96

-0.33

3.92

2.88

9.98

17.06

24.04

23.19

26.36

19.59

Maxima

10/10/2022

13.59

-0.33

4.79

0.45

-3.05

4.33

11.90

NA

NA

10.11

RH AlphaBots India Midcap 29

31/03/2023

3.00

-0.33

6.05

-2.37

1.92

13.02

NA

NA

NA

15.54

Unicorn MF Alpha Portfolio

30/05/2025

0.81

-0.33

3.82

2.46

NA

NA

NA

NA

NA

6.29

Vallum JAN Principles Approach

01/10/2025

2.47

-0.33

-0.97

NA

NA

NA

NA

NA

NA

-0.97

Diversified

06/09/2018

1.36

-0.34

2.16

1.47

5.61

11.43

33.53

25.79

26.48

21.52

Enhanced Portfolio 1

09/05/2017

7.76

-0.34

4.41

2.42

4.91

8.59

14.29

13.03

16.87

11.38

Bay Capital PBH

01/08/2025

84.40

-0.35

-0.35

NA

NA

NA

NA

NA

NA

-0.35

Care PMS Growth Plus Value

19/07/2011

868.64

-0.35

-2.22

-5.47

-3.14

7.52

18.24

14.36

24.77

20.39

Tata PMS Enterprising India Plus Investment Approach

18/10/2011

11.62

-0.35

4.95

3.75

10.97

14.69

15.34

11.28

13.62

11.54

ISEC Momentum Quality Dynamic Advantage Portfolio

17/11/2021

72.56

-0.36

6.35

-1.49

-0.98

10.42

20.01

11.04

NA

10.70

ASK DOMESTIC RESURGENCE PORTFOLIO STP

03/11/2019

4.30

-0.37

6.39

3.80

-0.87

5.74

12.97

8.41

13.43

13.18

Ace Multicap

23/08/2018

141.16

-0.38

7.05

3.94

8.17

15.73

32.83

26.71

28.89

20.17

ASK DOMESTIC RESURGENCE PORTFOLIO

21/06/2018

617.89

-0.38

6.34

3.91

0.25

6.89

13.82

8.94

13.74

12.21

ASK INDIA VISION PORTFOLIO

20/11/2019

73.75

-0.38

6.43

3.41

-1.43

3.88

9.94

4.83

10.25

10.76

High Conviction Equity Portfolio 1

18/05/2015

7.95

-0.38

4.45

3.12

4.69

11.71

17.88

12.62

15.20

11.84

Pearl Portfolio

01/01/2008

7.24

-0.38

4.51

-0.03

0.82

4.97

14.78

9.12

16.19

12.82

Select Large Cap Portfolio

23/01/2024

24.44

-0.38

4.89

2.67

4.14

NA

NA

NA

NA

12.66

TruBlu

05/03/2021

92.57

-0.38

6.09

3.10

12.82

11.32

15.73

13.57

NA

12.78

UNICORN ETF ALPHA PORTFOLIO

07/10/2024

8.76

-0.38

3.35

-1.05

2.80

NA

NA

NA

NA

-5.18

All Weather Equity

08/07/2022

269.27

-0.39

3.12

1.18

5.69

13.78

19.03

NA

NA

19.21

Avendus Margin Of Safety

20/01/2025

239.87

-0.39

0.22

-3.56

NA

NA

NA

NA

NA

1.17

FREEDOM ETF PORTFOLIO

09/03/2018

313.01

-0.39

4.90

1.83

6.68

10.95

16.70

10.68

14.70

11.71

High Conviction Equity Portfolio

01/04/2014

36.38

-0.40

4.71

2.40

5.16

11.28

17.81

12.92

15.12

16.79

I-Sec Multifactor Portfolio

13/01/2023

118.78

-0.40

5.48

1.68

2.97

8.85

NA

NA

NA

16.83

ICICI Prudential PMS Multi-Manager - India Equity Opportunities Strategy

19/11/2025

11.65

-0.40

NA

NA

NA

NA

NA

NA

NA

-0.03

Sticker Shock

25/06/2020

0.37

-0.40

-0.30

-3.63

1.23

0.46

5.82

2.55

6.40

7.71

Unicorn Scientific AI Factor Equity (SAFE) Portfolio

01/09/2025

0.51

-0.40

2.39

NA

NA

NA

NA

NA

NA

2.38

High Conviction Equity Portfolio Systematic Rebalancing Option

08/07/2019

87.42

-0.41

4.45

3.05

4.69

11.67

17.85

12.82

15.10

15.76

Funds India Dynamo Strategy

29/09/2025

18.28

-0.42

4.32

NA

NA

NA

NA

NA

NA

4.30

Master Trust India Growth Strategy

22/10/2011

374.68

-0.42

0.94

-4.65

3.91

8.02

19.01

14.08

23.27

24.72

Maxiom PMS - CORAL Cyclical

01/06/2025

0.70

-0.42

4.85

0.67

NA

NA

NA

NA

NA

1.77

Approach 1 Elite Opportunity

19/04/2017

0.45

-0.43

6.29

3.97

6.39

9.06

15.07

11.82

14.08

7.53

DELPHI 4C ADVANTAGE PORTFOLIO

06/11/2020

704.28

-0.43

3.98

2.24

6.54

14.36

18.86

14.16

15.54

16.36

EquiPoise India Select

24/08/2024

14.39

-0.43

3.62

1.43

6.75

NA

NA

NA

NA

4.85

Mojo Power

30/06/2023

183.45

-0.43

4.56

-1.95

-9.40

2.30

NA

NA

NA

6.70

Ametra FactorAlpha Smallcap PMS

21/10/2024

2.44

-0.44

-0.92

-9.49

-15.31

NA

NA

NA

NA

-13.80

Dezerv Capital Reserve Strategy - Equity

13/09/2024

289.90

-0.44

3.63

0.83

7.07

NA

NA

NA

NA

7.94

Enam India Opportunities Portfolio

04/05/2023

541.31

-0.44

5.63

4.79

4.67

11.73

NA

NA

NA

17.63

Julius Baer India Flexi Index Portfolio

08/03/2023

111.08

-0.44

5.67

1.59

6.91

10.65

NA

NA

NA